Legal Tech Trends Newsletter: #36

Legal scores a win and a loss in Bain survey, Jylo's commercial model resonates, LLM learnings, 100 Trend Reports, and much more

Happy Friday, happy 2025, and welcome to the 36th edition of Legal Tech Trends!👋

We’re back with our first edition of the year after a little break over Christmas.

Life moves fast, so it’s worth pausing for a microsecond to reflect on some worthy wins in the last 12 months. On the Legal Tech Trends front, we have more than doubled and grown to 3,000+ subscribers with readers from most leading law firms, legal departments worldwide, and all your favourite legal tech vendors. Thanks to all of you for sharing far and wide. 🙏

TITANS also had a record year. We shaped AI strategies, led vendor selection processes, and drove adoption for our clients’ top AI initiatives. Our AI market intelligence continues to guide executives’ critical AI decisions.

We’re fortunate to work with smart folks who think big and act with purpose. You can find a selection of their positive words on our beautiful new website. LINK

📊 Curious Charts

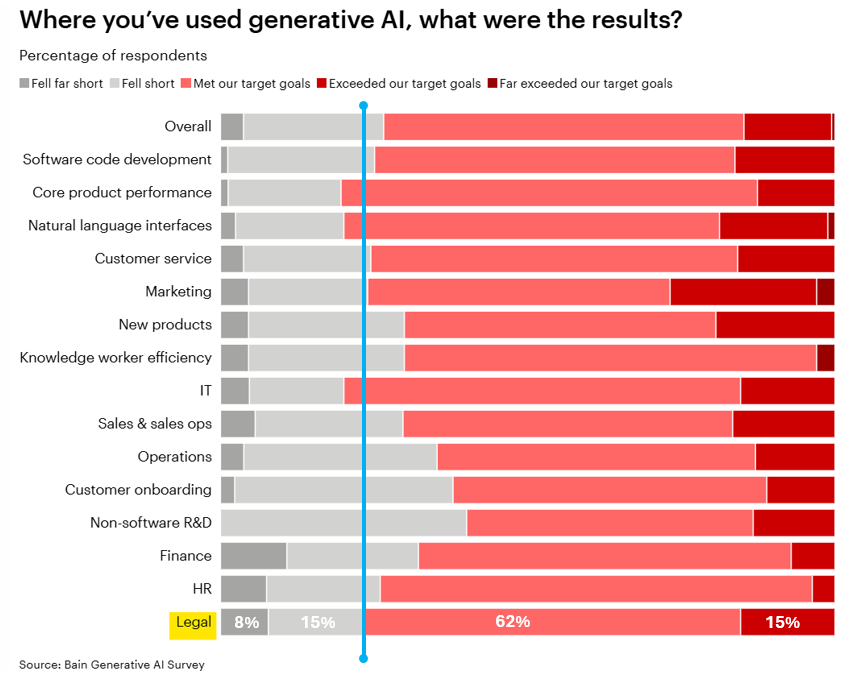

Last July, we shared a Bain survey suggesting that Legal respondents were the most disappointed by GenAI use cases so far and that disappointment was increasing.

Bain's latest edition of their regular survey paints a very different picture. It suggests that Legal is among the most satisfied user groups!

💫 77% of respondents reported that using GenAI in legal met their targets, the 4th highest of 15 categories listed.

🤔 But those with a keen eye will notice that Legal also ranks 2nd highest for respondents who said GenAI results “Fell far short”!

This is truly a chart that both gives and takes!!

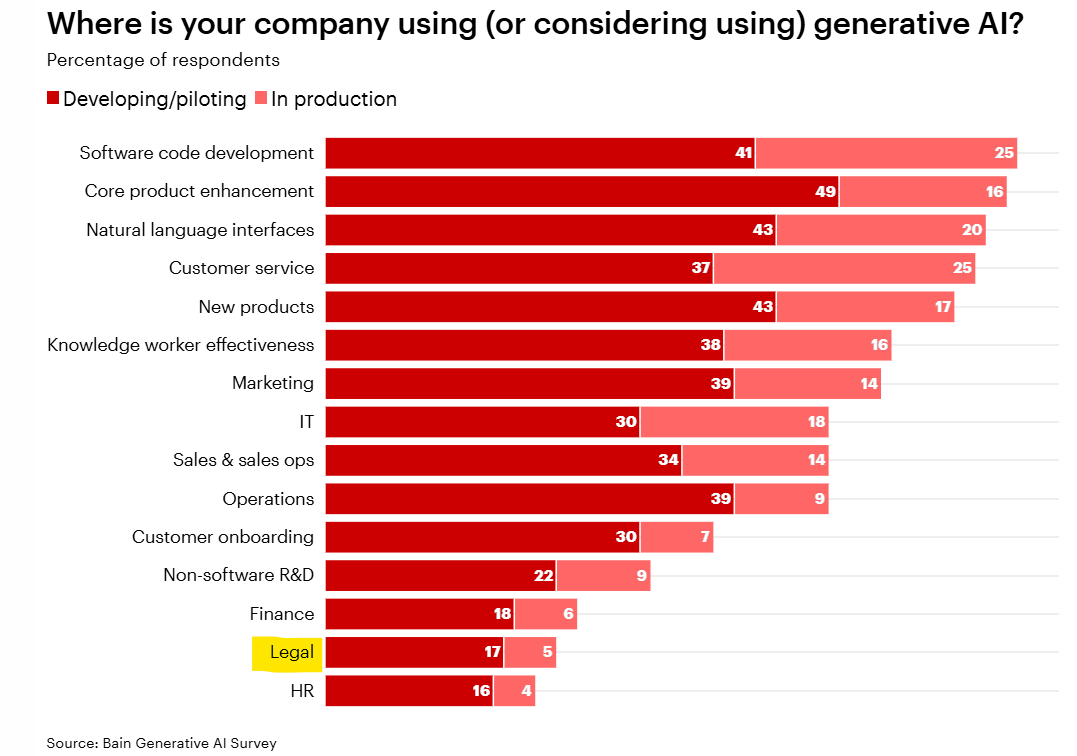

And before we get too excited. The same survey suggests Legal is the area with the 2nd lowest usage of GenAI! 🤷

In short, a very mixed message for legal, but more positive than the previous Bain survey that drew a lot of heated discussion. Few are using GenAI in legal, but those that are are mostly satisfied.

The survey respondents’ details aren’t mentioned in this report, which is frustrating, but the previous survey featured 200 corporate executives, so I would assume this is broadly similar.

Other highlights from the survey include:

Generative AI remains a top 3 priority for about half the executives surveyed and a top 5 priority for another 28%.

75% of executives said it poses a significant risk of disrupting their industry.

43% of respondents believe ‘Lack of skill with tools’ is why generative AI has not met some expectations. This is the most popular reason.

You can find all the details here: LINK

🎙️Podcast

In this Arch Law podcast episode, I had the pleasure of discussing the impact of AI on the legal industry with Ian Jeffrey, CEO of the Law Society of England and Wales, and Daniel Pollick, former CIO of DLA Piper and DWF, and a trusted technology advisor to Arch Law among other organisations. LINK

Sidenote: I’ve worked with Daniel on several iniatives, including when I was DWF’s Head of Emerging Technology. Here is an extract from a note I shared with the team in January 2021. Safe to say it still ranks amongst my favourite trends!

AI

💫 Howard Kennedy implements Jylo to further GenAI strategy

In edition 28 last May, we covered Shawn Curran and the Travers Smith AI team spinning out of Travers Smith to launch a standalone legal tech company called Jylo.

This team has a strong track record and is particularly well known in the UK, where they have announced law firm Howard Kennedy as a customer, who called out the following product strengths:

Practice groups can control large language model selection for specific use cases.

A commercial model that enables buyers to enter at a level they are comfortable with and expand as needed.

Transparency over token charges to help maintain control of costs.

GenAI products are often considered expensive compared to traditional non-AI software products, so pricing and cost containment approaches are particularly topical. LINK

🎯 Inhouse-Focused Robin AI Goes After 60,000 ‘Small Law’ Lawyers

RobinAI has partnered with Dye & Durham to bring RobinAI’s product to market for Dye & Durham customers. This expands RobinAI’s target customer segment beyond the legal department market, where they already work with companies such as Pfizer, UBS and GE. LINK

🚀 LexisNexis launches Data+ API

The API gives organisations access to an extensive repository of trusted, high-quality data from more than 23,000 licensed publications, legal data (e.g., dockets, verdicts, settlements, patent filings, etc.) and compliance data (sanctions, watchlists, politically-exposed people).

Potential use cases for the data include AI model training, GenAI applications, and risk modelling. LINK

👏 I built and sold a legal tech startup during my training contract at A&O

Safe Sign Technologies was a little-known company before Thomson Reuters bought it last August. This article covers how its young founder, Alexander Kardos-Nyheim, ran the company alongside his day job as a trainee at A&O Shearman. A majorly impressive feat, and I doubt many could replicate his daily schedule! LINK

Roundup

🚀 KPMG Seeks License to Operate US Law Firm Based in Arizona

The move aims to expand KPMG's legal services by integrating legal capabilities into managed services, such as contract lifecycle management. Currently, KPMG can only offer legal-adjacent services in the US, but approval would allow it to practice law more comprehensively, targeting large-scale, process-driven legal work.

Sidenote - The US is way behind the UK in allowing entities to provide legal services even if some of their owners are not lawyers. Arizona and Utah have eased this requirement in recent years, whilst the UK removed the restriction in 2007!

A recent report from TheCityUK & Barlays suggests that 12% of England and Wales’ nearly 10,000 law firms are now operating as alternative business structures (ABS) LINK

Raises & Acquisitions

💸 UK legaltech Lawhive secures $40M Series A for US market entry

The startup focuses on helping consumers quickly find lawyers at a fraction of the cost of high-street firms, calling out their desire to use AI to make legal services more accessible and affordable. They help people with various issues like family, property, disputes, consumer rights and small business issues. Their technology gives lawyers tools that cover workflow management, compliance, and payments. LINK

🤑 GenAI litigation startup Wexler AI raises $1.4m pre-seed funding

In our last edition, we covered UK law firm Burgess Salmon’s announcement that they’d become a customer of the Wexler. Wexler is on a nice roll, having now raised $1.4m and publicised their work with Clifford Chance. LINK

💰 nQ Zebraworks Raises Additional $4.5M to Drive Growth of Its Cloud ‘Invoices-to-Cash’ Solution LINK

💸 Pocketlaw Raises Nearly €5m For AI Development

The round will help the CLM provider to support enhancements to its AI product development and expand its operations across Europe. LINK

💵 Elite acquires B2B payments platform Tranch

Elite, the financial management solution formerly fully owned by Thomson Reuters before they sold a majority stake to TPG private equity group in 2023, has acquired Tranch, an invoice automation and payments platform. LINK

Adjacent Interests

🎓 Things we learned about LLMs in 2024 LINK

🔭 100+ trend reports for 2025 LINK

🎁 A16z’s Apps unwrapped - their favourite AI apps of 2024 LINK

That’s a wrap. Thanks for reading. If you enjoyed it, take a second to forward this email to a colleague who might also appreciate it.

Have a great Friday!

About me.

I’m the founder of TITANS, a LegalTech and AI consultancy for leading law firms and new law companies. We help some of the largest legal service providers shape their AI strategies, expedite vendor evaluation, and accelerate user adoption.Legal Tech Trends is my fun outlet to share my hype-free positive take on LegalTech and AI market developments, informed by my 10+ years technology consulting with leading corporates and legal service providers.

Connect with me on LinkedIn for more LegalTech market insights Here 👋

Excellent read thanks Peter