Legal Tech Trends Newsletter: #37

Law firms lead AI adoption, Macfarlanes unveils subscription offering, AI Voice Agent update, and much more!

Happy Friday, and welcome to the 37th edition of Legal Tech Trends!👋

It’s been an exciting few weeks. We’ve had our heads down helping clients accelerate their GenAI journey, which includes various vendor selection, pilot delivery, education and market intelligence engagements.

The LegalTech market has been particularly eventful recently. This edition has a lot, so I’ve shortened the explainer text to respect your time and added a 🌟 next to my top three highlights!

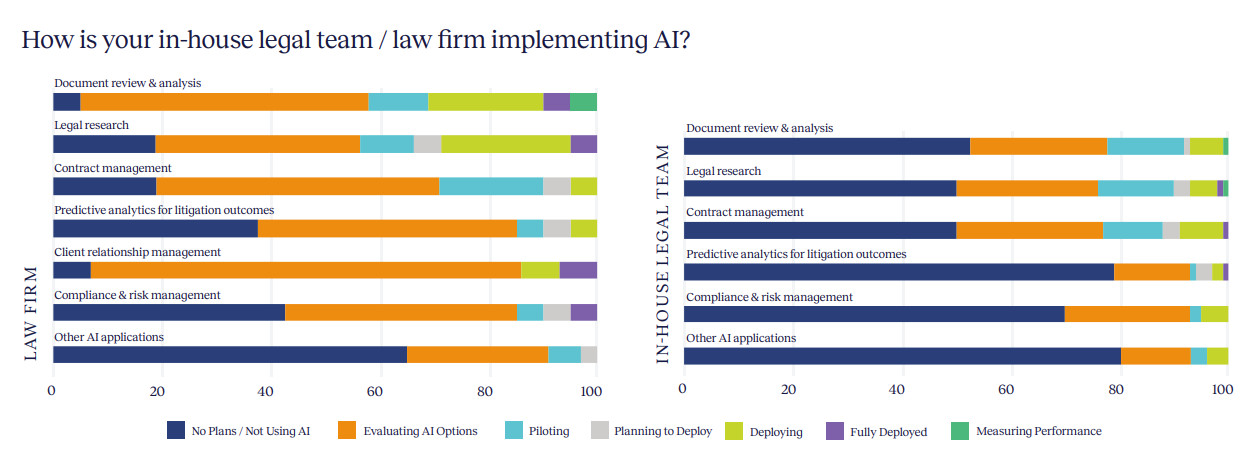

📊 Curious Chart - Law firms lead in-house teams in AI adoption

Considering the incentives of law firms to sell billable hours, one might assume that in-house legal teams could be faster in adopting GenAI. Indeed, I’ve spoken with in-house teams fitting that bill, but it appears they do not represent the broader market.

A recent survey by Consilio suggests that law firms are embracing GenAI in significantly greater numbers than in-house teams.

I merged two charts from the report and combined answer categories to present the results in a visual that aligns with how my brain likes to interpret data!

You can see the original charts below, and view my re-categorisation:

🟢Adopting = Deploying, fully deployed, and measuring performance.

🟠Assessing = Evaluating AI Options, Piloting & Planning to Deploy.

Additional survey highlights:

US respondents are far more concerned with understanding, choosing, and deploying new technologies, including AI, compared to the global average.

Nearly twice as many US respondents (42%) identified this as a top challenge, compared to 24% globally.

The full report is worth reading, and you can find it here: LINK

Special thanks to Jonny Badrock and the Consilio team for humouring my request for the source data to create my visual! 🙏

AI

🌟Macfarlanes unveils subscription-based client GenAI document analysis tool in partnership with Harvey 🌟

Having rolled out Harvey across the firm, Macfarlanes is offering clients access to the technology and the firm’s legal expertise for a monthly fee. The mentioned use cases include assessing contracts, identifying key provisions that require action, and determining which stakeholders need to be alerted of developments. LINK (Paywall) or LINK (No paywall)

Sidenote: This is particularly noteworthy, as it hits on key trends like new pricing models and client GenAI adoption, in this case through tech provided via a law firm. I also like that Macfarlanes has called out the necessity of a ‘discovery phase’ for each client, highlighting the upfront work needed to identify tasks, workflows, and time needed to optimise the tool for each client use.

💡 Womble Bond Dickinson first UK law firm to sign up to Thomson Reuters CoCounsel AI firmwide

The firm begins its roll-out this month, highlighting legal research, document review and analysis, and correspondence drafting as key use cases. LINK

This quote from Sam Dixon, Chief Innovation Officer at Womble Bond Dickinson, is particularly striking:

“We believe that it will become increasingly clear to the profession that lawyers can no longer offer truly exceptional client service without working alongside AI.”

🚀 Bloomberg Law Rolls Out Two AI-Powered Legal Research Tools

Bloomberg Law Answers gives answers to legal queries, while AI Assistant enables users to generate summaries and inquire about specific documents. Both features are free for current subscribers. LINK

💡American Arbitration Association Partners with Clearbrief to Offer AI-Powered Legal Writing Tools To Its Panelists and Parties

The AI legal writing tool will be accessible to AAA-ICDR’s 5,500 arbitrators and mediators, improving their ability to create timelines, summarise evidence, and automate fact-checking. It will also be offered to parties in AAA-ICDR proceedings for a fee. LINK

🚀 LexisNexis formally launches Protégé AI assistant and Create+ AI drafting solution in MS365

The Protégé AI assistant replaces the previous Lexis+ AI Assistant and is now available in the US. The Create+ AI solution originates from their acquisition of Henchman and is now accessible in the US, UK, and Canada. LINK

🌟 Paul Hastings Ex-Partner launches SmartEsq 🌟

The startup aims to slash the legal costs of private equity fund formation by up to 75%, using a small team and GenAI to streamline specific workflows. LINK

Sidenote: This sounds like a fantastic combo: BigLaw Partners + very specific workflows + GenAI. (People, Process, Tech)

Raises

💰 Ivo raises $16m For AI Contract Review

The start-up focuses on pre-execution contract review for in-house teams and serves 150 clients, including Canva, Eventbrite, and Quora. They’re also releasing a ‘Search Agent’ to search and generate reports across entire contract portfolios, regardless of where your contracts are stored. LINK

Sidenote: As can be seen from the Screens story below, this ‘pre-execution contract review’ use case is very topical. I find contract review incredibly tedious, and now can’t imagine reviewing contracts without AI! I have seven(!) plugins in MS Word to call on as needed.

💸 Eve Raises $47M in Round Led By Andreessen Horowitz

The AI platform for plaintiff law firms has features to streamline legal processes, including document drafting, discovery, and legal research. They are expanding the platform offering to enhance the production of medical chronologies, drafting demand letters, calculating damages, and identifying key case risks. LINK

🤑 Semeris secures £3.5m for legal AI in finance

The startup focuses on collateralized loan obligations (CLO), asset-backed securities, mortgage-backed securities and similar offerings. Four of the top five global CLO law firms utilise its platform for market analysis and efficient drafting through a blend of AI and human in the loop. LINK

💶 Danish legaltech Pandektes raises €2.9M to streamline casework

The funding will enhance its database of legal rulings across all EU jurisdictions, providing efficient tools for navigating legislation and case law for legal professionals and institutions. Legal councils, public institutions and large law firms in Germany and Denmark currently use its services. LINK

💸 Paxton Secures $22M Series A Funding

The AI legal assistant platform has secured $22 million in Series A funding, increasing its total funding to $28 million. The product caters to a diverse client base, from solo practitioners to large law firms, with tools for legal research, document drafting, and analysis. LINK

💰 Lawpath secures AUS $10m and exclusive partnership with Westpac Bank

This partnership aims to make essential legal services more accessible and affordable for Australian small businesses. LINK

💵Regulatory Intelligence Platform Abstract Announces $4.8 Million

The startup uses natural language AI to abstract existing and changing laws to make government more accessible. The raise brings their total funding to over $9 million. LINK

Acquisitions

🌟 CLM Agiloft Buys Screens, TermScout Will Continue 🌟

Screens will continue to operate independently while also integrating into Agiloft's tech stack, enhancing pre-execution document review. LINK

Sidenote: I’ve used the Screens product regularly, along with other similar pre-execution tools, since they launched in February last year. I was impressed by their great product design, unique position in the market with their community-created playbooks, and openess in publishing accuracy benchmarks.

🎥 The L Suite, A Community for GCs and CLOs, Acquires Luminate+ To Expand Members’ Access to CLE Content

The L Suite’s 4,000+ members will gain free access to the Luminate+ platform to view high-quality CLE-accredited videos on demand. LINK

Sidenote: CLE requirements vary significantly in the US, with distinct rules for each state. For instance, New York has specific rules for delivering and tracking on-demand CLE content. I’ve enjoyed exploring thse nuances recently!

🗃️ Onit Acquires Legal Files, A Provider Of Case and Matter Management Software

Legal Files has been around since 1990 and has more than 500 customers, with a strong focus on insurance companies, universities, and state and local governments. LINK

🤝 Elevate acquires 500-strong IP research company Sagacious

Sagacious serves a global clientele, including Fortune 500 companies and IAM1000-listed firms, helping them to monetise and defend intellectual property. LINK

🥬 Litera Buys Peppermint

Well known for their acquisitions, this is Litera’s largest since Kira. Peppermint is a UK-based Microsoft partner known for its CX365 CRM and matter management solutions. LINK

Adjacent Interests

💬 A16z’s AI Voice Agent Update - 2025 LINK

Companies building with voice represented 22% of the most recent YC class!

Sidenote: I’m majorly excited by voice-first interfaces and currently love using voice to capture elaborate prompts and detailed context when using ChatGPT.

💡Deepseek has dominated AI headlines recently. The US vs China aspect generates significant interest, but aside from the model's origin, the news isn’t majorly surprising and follows trends we’ve observed for some time:

⬇️ The cost of GenAI continues to drop dramatically.

⬆️ Open-source models continue to improve.

🔀 It’s prudent to have a multi-model approach. (This was widely accepted since OpenAI’s short-lived ousting of Sam Altman).

🎙️ Damien Riehl and Horace Wu had my favourite coverage on the topic in their recent podcast: DeepSeek and the Seven Dwarf Problems for LegalTech (ft Joe Rayment)

That’s a wrap for this bumper edition! Thanks for reading. If you enjoyed it, take a second to forward this email to a colleague who might also appreciate it.

Have a great Friday!

About me.

I’m the founder of TITANS, a LegalTech and AI consultancy for leading law firms and new law companies. We help some of the largest legal service providers shape their AI strategies, expedite vendor evaluation, and accelerate user adoption.Legal Tech Trends is my fun outlet to share my hype-free positive take on LegalTech and AI market developments, informed by my 10+ years technology consulting with leading corporates and legal service providers.

Connect with me on LinkedIn for more LegalTech market insights Here 👋